Fintech Lending Market Overview:

The Fintech Lending Market is witnessing steady growth as financial technology (fintech) continues to revolutionize the traditional lending landscape. In 2022, the market was valued at USD 332.56 billion, and it is projected to grow to USD 525.0 billion by 2032. This expansion represents a compound annual growth rate (CAGR) of 4.67% during the forecast period from 2024 to 2032.

Market Overview

Fintech lending refers to the use of innovative technology to offer loans and other financial services through digital platforms, bypassing the traditional banking system. This market encompasses a wide range of services, including peer-to-peer (P2P) lending, online lending platforms, and alternative financing solutions. The fintech lending industry has gained significant traction due to its ability to provide quick, accessible, and often lower-cost loans to consumers and businesses alike.

Request For Sample Report PDF - https://www.marketresearchfuture.com/sample_request/22833

Key Drivers of Growth

-

Increased Demand for Quick and Accessible Loans: The demand for quick and easy access to credit is one of the primary drivers of growth in the fintech lending market. Traditional lending processes are often slow and cumbersome, involving extensive paperwork and lengthy approval times. Fintech lenders, on the other hand, leverage advanced algorithms, artificial intelligence (AI), and big data analytics to expedite the loan approval process, making credit more accessible to a broader audience.

-

Rising Adoption of Digital Platforms: The global shift towards digitalization has fueled the adoption of fintech lending platforms. Consumers and businesses alike are increasingly turning to online platforms for their financial needs, from applying for loans to managing repayments. This trend has been further accelerated by the COVID-19 pandemic, which pushed many consumers and businesses to embrace digital solutions.

-

Cost-Effective Lending Solutions: Fintech lenders often operate with lower overhead costs compared to traditional banks, enabling them to offer competitive interest rates and fees. This cost advantage makes fintech lending an attractive option for borrowers, particularly small and medium-sized enterprises (SMEs) and individuals who may face challenges accessing credit through traditional channels.

-

Expanding SME Sector: The growing small and medium-sized enterprise (SME) sector, particularly in emerging markets, is another key driver of the fintech lending market. SMEs often struggle to secure loans from traditional banks due to strict lending criteria and a lack of collateral. Fintech lenders offer more flexible financing options, catering to the unique needs of SMEs and supporting their growth.

-

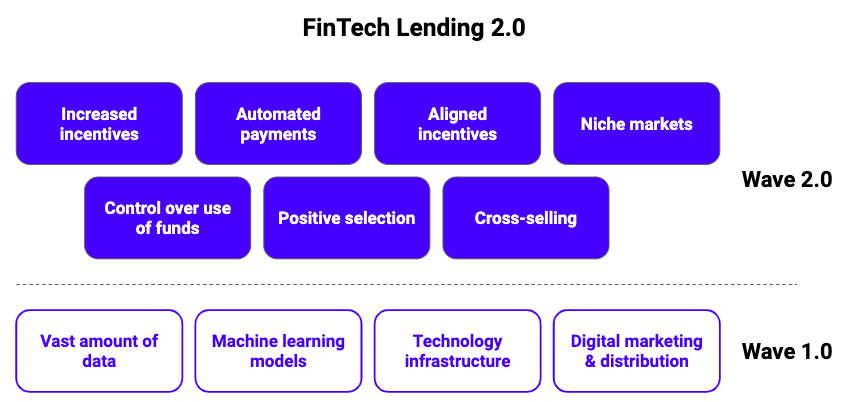

Technological Advancements: Advances in technology, such as AI, machine learning, blockchain, and data analytics, are enhancing the capabilities of fintech lending platforms. These technologies allow for more accurate risk assessments, improved customer experiences, and the development of innovative lending products. As a result, fintech companies are better equipped to meet the evolving needs of borrowers.

Market Segmentation

The Fintech Lending Market can be segmented based on product type, end-user, and region:

-

Product Type: The market is segmented into personal loans, business loans, and others. Personal loans are currently the dominant segment, driven by high consumer demand for quick and convenient access to credit.

-

End-User: The market serves both individual consumers and businesses. While individual consumers represent a significant portion of the market, the business segment is expected to see robust growth, particularly among SMEs.

-

Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America currently holds the largest market share, followed by Europe.

Regional Analysis

-

North America: North America is the largest market for fintech lending, driven by a mature financial services industry and high levels of digital adoption. The U.S. is the key market within the region, with a strong presence of fintech companies and a favorable regulatory environment.

-

Europe: Europe is another significant market, with strong demand for fintech lending services in countries like the UK, Germany, and France. The region's well-established financial infrastructure and growing appetite for digital solutions are key factors driving market growth.

-

Asia-Pacific: The Asia-Pacific region is expected to witness the fastest growth during the forecast period, fueled by a rapidly expanding fintech ecosystem, particularly in countries like China, India, and Southeast Asia. The region's large unbanked population and growing smartphone penetration are driving the adoption of fintech lending platforms.

Future Outlook

The Fintech Lending Market is poised for steady growth over the next decade, with a projected CAGR of 4.67%. As digitalization continues to reshape the financial services industry, the demand for fintech lending solutions is expected to rise. Companies that focus on innovation, customer-centric services, and leveraging advanced technologies are likely to capture a significant share of this expanding market.

In conclusion, the Fintech Lending Market represents a dynamic and rapidly evolving segment of the global financial services industry. With an expected market size of USD 525.0 billion by 2032, this market offers substantial opportunities for growth, innovation, and investment, driving the future of lending in the digital age.